Income earned by a person who resided in Thailand for a total of 180 days. After all tax exemptions for these entities should be filed through the EA form and this is possible to generate in an HR software like Talenox absolutely free-of-charge.

How To Claim Income Tax Reliefs For Your Insurance Premiums

Easily calculate your tax rate to make smart financial decisions Get started.

. See the Departments circular note dated April 10 1991. Important Terms and Definitions under The Income Tax Act 1961 Assessment year and previous year As per Section 29 of the Income Tax Act 1961 states that assessment year means the 12 month period beginning on the 1st day of April every year. If you are employed.

This section of the Income Tax Act 1961 is related to deductions on profits gains earned from taxpayers businesses related to collection processing of bio-degradable wastes for the production of biological products such as biogas etc. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Your Income Tax Number is a unique reference number that is to be used by you in all dealings with the Inland Revenue Board of Malaysia Malay.

Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income. Income Tax on Earnings. Domestic travel travelling within Malaysia expenses have RM100000 tax relief.

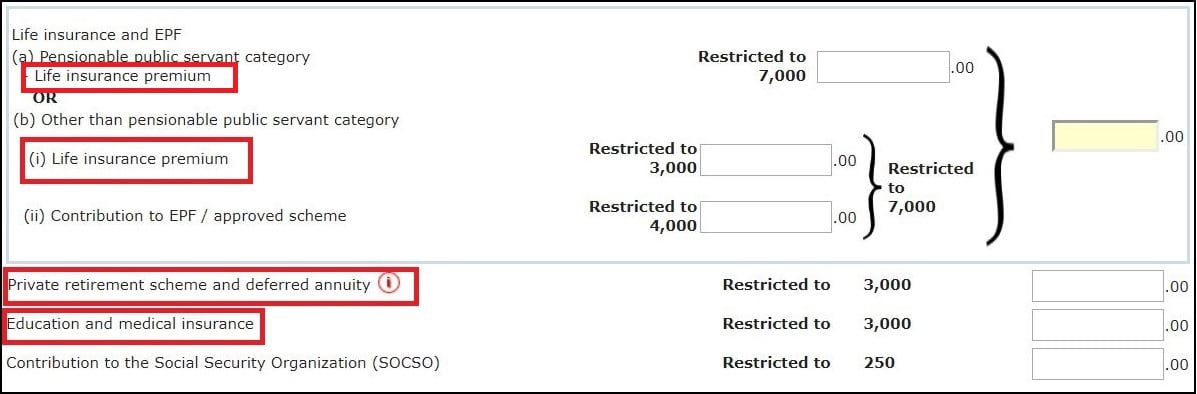

The Income Tax Number is allocated by the Inland Revenue Board of Malaysia when you register for tax. Hence all the tax exemption on allowances benefit-in-kind and perquisites must be excluded in this case. To illustrate how you should calculate your insurance tax reliefs heres a scenario.

Housing and meal allowances or their value. As a result most employees will not be required to lodge Form S returns. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia.

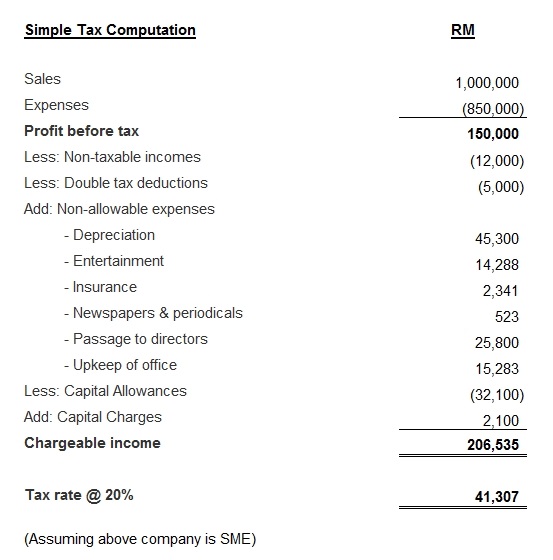

The statement of profit or loss As IAS 12 considers deferred tax from the perspective of temporary differences between the carrying amount and tax base of assets and. Income tax in Thailand is based on assessable income. Income tax information for A or G visa holders.

The movements in the liability are recorded in the statement of profit or loss as part of the income tax charge. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Malaysia follows a progressive tax rate from 0 to 28. The deadline for tax payment is the same as tax finalization meaning no later than 90 days from the end of the calendar year. Get tax saving worth RM300000 for childcare expenses for children up to 6 years old.

Tax Offences And Penalties In Malaysia. The definition of assessable covers the following. School fees for dependents paid for by employer.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. How To Pay Your Income Tax In Malaysia. Marginal Tax Rate US.

The documents required for claiming the tax deduction under Section 80E of the Income Tax Act 1961 are. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e-filed or printed not including returns. Know how much to withhold from your paycheck to get a bigger refund.

The closing figures are reported in the statement of financial position as part of the deferred tax liability. Malaysia Income Tax Relief. Lembaga Hasil Dalam Negeri Malaysia abbreviated LHDNM.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. PCB is deducted from the employees taxable income only.

Can avail income tax exemption of equal to 100 of the generated profit for 5 continuous years since. Documents Required for Claiming Deduction under Section 80E of the Income Tax. Guide To Using LHDN e-Filing To File Your Income Tax.

Supporting Documents If you have business income. Read more are bifurcated into seven brackets based on their taxable income. PAYE became a Final Withholding Tax on 1st January 2013.

An individual needs to get a certificate from the Bank or financial institution or from the charitable institute that is approved and from which the loan is taken. Wages paid in Thailand or abroad. This is because the correct amount.

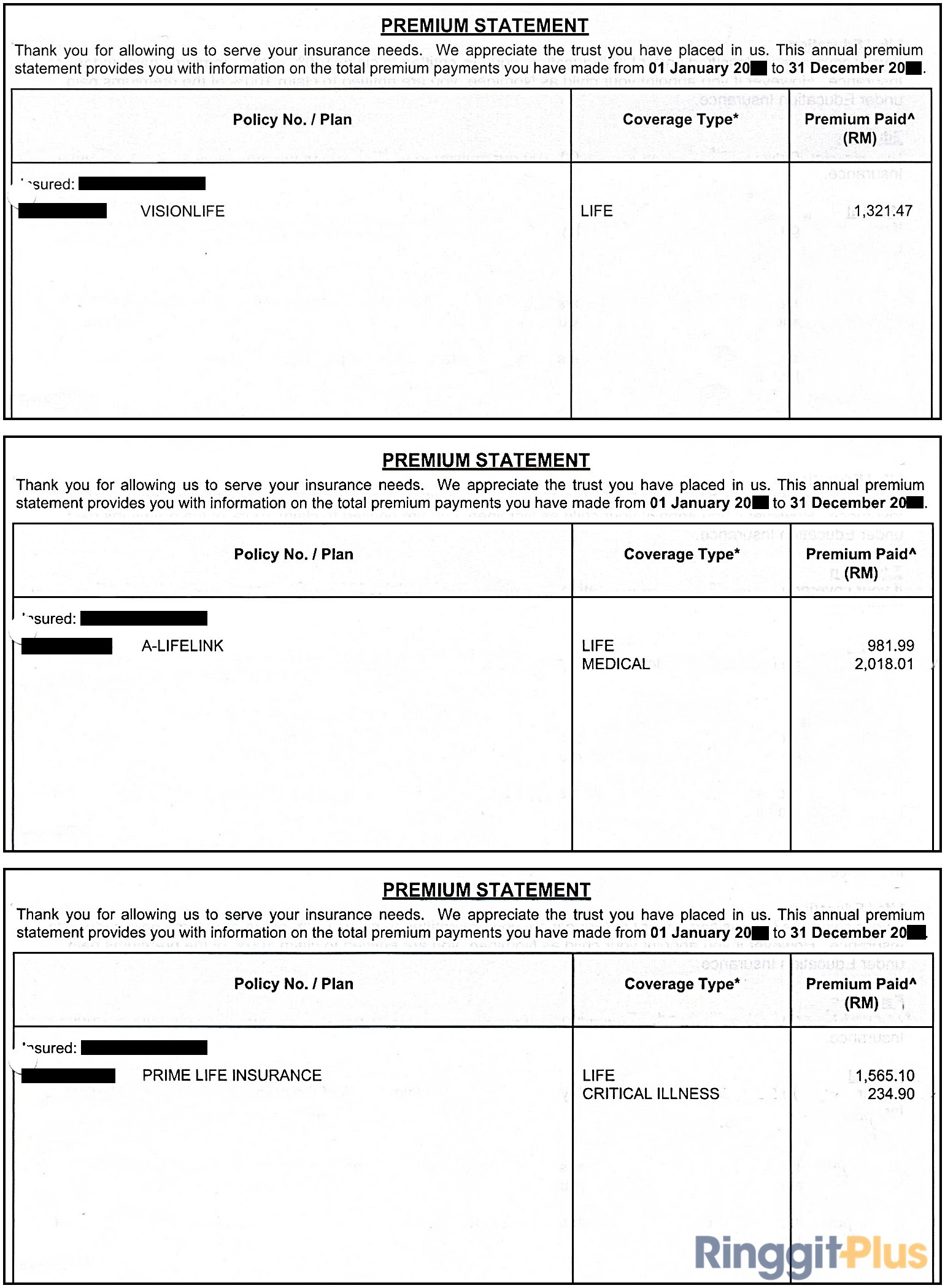

An individual has three insurance plans with AIA that includes a few types of coverage. In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws. Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment rental of sporting facilities payment of registration or competition fees.

How Does Monthly Tax Deduction Work In Malaysia. Life insurance and EPF. Locally hired foreign mission employees If you are permanently resident in the United States for purposes of the Vienna Conventions you are not entitled to the income tax exemption available under the Vienna Conventions.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. The assessee is required to file the income tax return of the previous year in the assessment year. Conversion of taxable income If the taxable income is received in a foreign currency it must be converted into Vietnamese dong at the average trading exchange rate on the inter-bank foreign currency market published by.

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Cukai Pendapatan How To File Income Tax In Malaysia

How To Claim Income Tax Reliefs For Your Insurance Premiums

Malaysian Income Tax Calculator For Foreigners Samirctzx

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

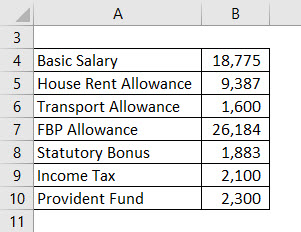

Salary Formula Calculate Salary Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Malaysian Tax Issues For Expats Activpayroll

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Director Medical Fees Tax Deductible Malaysia Clarkctz

Salary Formula Calculate Salary Calculator Excel Template

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To Get Income Tax Number Malaysia Aaronctz

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

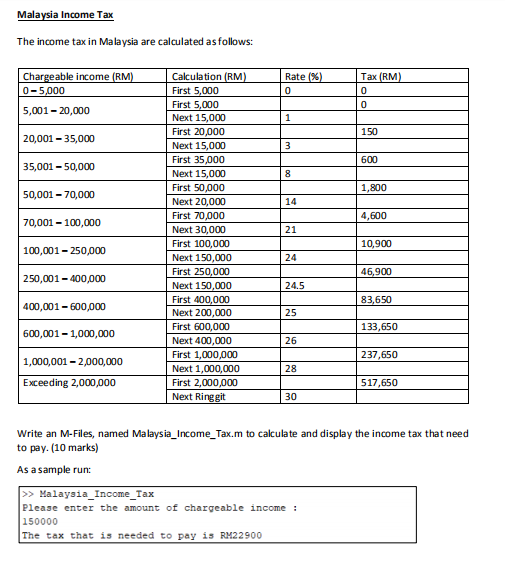

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

Income Tax Malaysia 2018 Mypf My

How To Claim Income Tax Reliefs For Your Insurance Premiums

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022